Director Disqualification after Condonation of Delay Scheme (CODS)

In order to relieve Companies and to give them opportunity from mass disqualification of Directors, Government came up with Condonation of Delay Scheme (CODS) vide circular dated 6th and 12th September 2017. Ministry of Corporate Affairs came up with CODS vide a general Circular No.16/2017, which was effective w.e.f. 01st January 2018 till 01st May 2018. Innumerable companies took advantage of this COD Scheme in order to revive their Director Identification Numbers (DIN) by submitting certain statutory documents pending with Registrar of Companies (ROC).

But what now after the expiry of CODS? In this article, we will discuss redressal available to companies after the expiration of CODS.

What was Condonation of Delay Scheme (CODS)?

The Ministry of Corporate Affairs (MCA) disqualified around 3 lakh directors under Section 164(2) and 167(1)(a) of the Companies Act in around September 2017, who have failed to file statutory documents with ROC from last 3 years. MCA gave status to such companies as "Strike off", additionally blocked DIN of all the disqualified directors in order to take preventive measure. As a solution, Government came up with CODS which was in force from 1st January 2018 till 31st March 2018 but further extended by General Circular No. 02/2018 and General Circular No. 03/2018 till 1st May 2018.

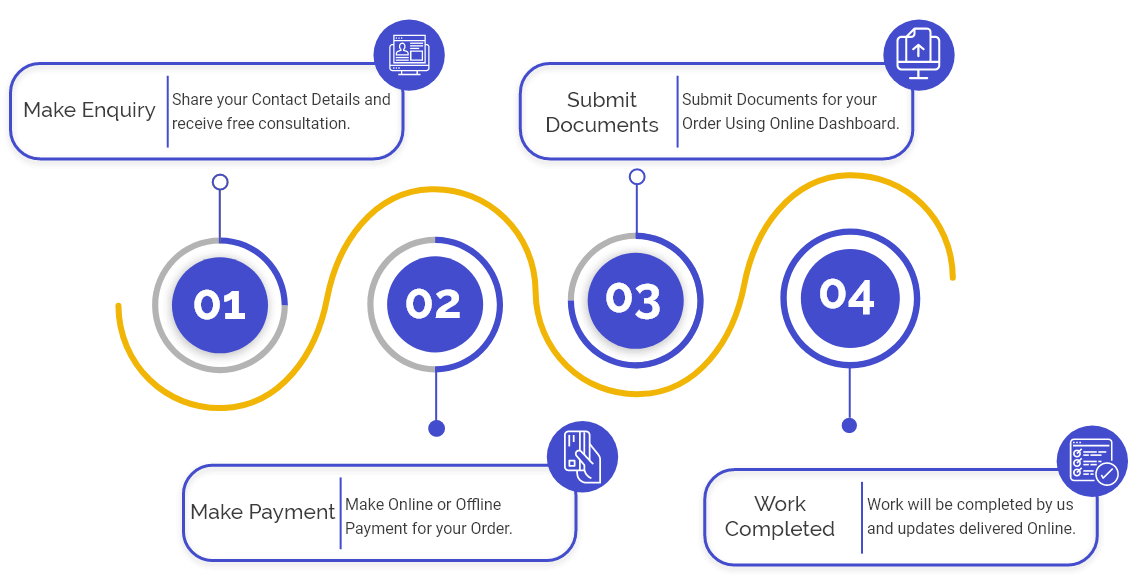

What was the procedure to be followed under CODS?

- As under the COD scheme, disqualified directors were permitted to file the pending documents with ROC. So, in order to enable disqualified directors to file pending statutory documents with ROC, their DIN was temporarily activated to file due documents.

- The defaulting company was required to file the overdue documents besides statutory fee as prescribed under Section 403 of the Companies Act.

- Further, the defaulting company sought Condonation of Delay by filing e-CODS, 2018 form by online mode along with a compulsory fee of Rs. 30,000/-.

- DIN of directors of defaulting companies, which failed to file pending statutory documents along with required fee upon expiry of CODS scheme, were again deactivated.

- The defaulting companies which have been struck off by ROC, their director's DIN can only be activated after Hon’ble NCLT orders of the revival of Company.

What is the procedure to get DIN activated as per the latest provisions?

- Step-1:

Filing of Writ Petition- Disqualified Director is required to file a Writ petition under Article 226 of the Constitution of India before Hon’ble High Court. In the said writ petition Appellant is required to accompany the following correspondence:

- Urgent Application;

- Notice of Motion;

- Memo of parties: Parties to the petition i.e. Name, Address, Designation etc;

- Synopsis and list of date and events;

- Circumstances which lead to non-compliance of filing of statutory documents;

- Status of company and directors seeking restoration;

- Prayer clause for setting aside the publication issued by ROC i.e. Impugned List of Disqualified Directors under Section 164 (2) (a) of the Companies Act, 2013;

- Copy of press release/impugned notice issued by ROC listing disqualified directors;

- List of all companies in which Appellant is Director;

- Stay application under Section 151 of CPC;

- Step-2:

Companies whose name has been struck off can also file an Appeal under Section 252 of the Companies Act, 2013 before the National Company Law Tribunal to restore the name of the company with ROC;

- Step-3:

After getting orders of DIN reactivation and revival of struck off company from Hon’ble High Court and NCLT, Appellant is required to file Statutory documents with ROC and Annual returns of last 3 years with the Income-tax authority.

- Step-4:

After all the compliances and payment of the penalty, if any imposed by Appellant, ROC is required to raise a ticket on MCA21 portal through Change Requirement Form (CRF). ROC also needs to upload a copy of the said order on the portal. After validation, the deactivated DIN will get reactivate.

What now after Condonation of Delay Scheme?

After expiration for CODS, 2018, several disqualified directors made a proposition before Hon’ble High Court and National Company Law Tribunal (NCLT) to restore their DIN’s and revive their Companies. They filed a Writ Petition under Article 226 of the Constitution of India in order to issue Writ of Certiorari for setting aside the notification of MCA of disqualification of Directors and to revive the Struck off companies and reactivate DIN under Section 252 of the Companies Act, 2013.

In response to this, the Ministry of Corporate Affairs gave clarification in regards to CODS vide a general Circular No.5/2018 dated 17th May 2018. As per the notification:

- The defaulting companies which have been removed from the registrar of companies by MCA and the petition for the revival of companies under Section 252 is pending before a tribunal, then struck up companies can pursue CODS even after the expiry date of the scheme.

- Where the company has been struck off, the DIN of disqualified director can be reactivated only after getting NCLT Order and after complying and filing of all pending documents.

- In such cases, after obtaining an order from NCLT, ROC is required to raise a ticket on MCA21 portal through Change Requirement Form (CRF). ROC also need to upload a copy of the said order on the portal. After validation, the deactivated DIN will get reactivate.

- It is pertinent to mention that disqualified director whose DIN is proposed to be activated through CRF must not be the director of any other struck off company. And ROC is required to do proper scrutiny of NCLT orders and compliance of all overdue requirements.

Conclusion

In order to provide remedy to disqualified directors and to revive struck off companies even after COD scheme, the Ministry of Corporate Affairs (MCA) has undertaken a remarkable step by issuing recent Circulars, which not only helped companies to restore their name with ROC by giving them more time but also giving opportunity to revive struck off companies by filing annual statements and other statutory documents.

Frequently Asked Questions

The term “Condonation of Delay Scheme 2018” denotes a Scheme that is introduced by the Central Government as a golden opportunity for the non-compliant and defaulting companies to rectify their default.

The Central Government introduced the Condonation of Delay Scheme by exercising its powers conferred under section 403, 459, and 460 of the Companies Act 2013.

The Condonation of Delay Scheme become operative from 01.01.2018 to 31.03.2018. That means the scheme was to be complied within 3 months.

The CODS is applicable to all the companies registered in India, such as Private Limited Company, Public Limited Company, One Person Company, Section 8 Company.

NO, the Condonation of Delay Scheme will not apply to those defaulting companies whose names have been removed or struck off from the register of companies maintained under section 248 of the Companies Act 2013.

The steps included in the process to comply with CODS are that the Deactivated DIN of the Defaulting directors will be re-activated for a temporary purpose only. After that, the defaulting company will file overdue documents.

The term overdue documents include Financial Statements, Form AOC 4, Annual Returns, Compliance Certificate, Form ADT 1 for Auditor Appointment, etc.

Yes. The condonation of delay scheme is applicable only on a defaulting company.