An Overview of NBFC Account Aggregator License

NBFC Account Aggregators are entities that enable sharing of data across multiple financial sector organisations and act as "consent brokers", i.e., the intermediate data transfer among the financial organisations with the consent of the user. RBI announced this in September 2016, stating master directions for a new class of NBFCs called Account Aggregators.

What does Account Aggregation Mean?

Account Aggregation is the accumulation of financial data that involves gathering information on a single platform from varied accounts such as bank accounts, investment accounts, business accounts, consumer accounts and other financial-related accounts.

- Account Aggregators are financial entities that provide structured financial data sharing from Financial Information Providers (FIP)to Financial Information Users (FIU). The consent is taken from the users to transfer this information. This right of managing and revoking the consent lies with the users.

- Financial Information Providers (FIP): FIP refers to financial entities that provide account information of a user upon the request of another entity/individual and are regulated under the financial sector.

- Financial Information Users (FIU): FIU refers to the entities that require or take the information of a certain user(s) from FIP for multiple uses such as market assessment, customer analysis etc. This includes both organisations and individuals. These are regulated under statutory bodies like RBI, SEBI, IRDA and PFRDA.

Note: The Financial Information is shared in accordance with the master direction issued by RBI-DNBR (Department of Non-Banking Regulations).

What is the meaning of NBFC Account Aggregator?

NBFC Account Aggregator is a financial entity which works as an Account Aggregator for the customers of NBFC. NBFC-AA provides information regarding multiple accounts that are held by the customers in different NBFC entities. The customer account information will be in the form of consolidated, organised and retrievable data that would reveal the financial engagement of the customer in different NBFC products like mutual funds, insurance etc.

Consent Manager for Transferring Financial Data

NBFC-AA will provide the users with a platform to make data payments or transfer financial data of various accounts of the user to any entity that desires access to that data (FIU). The consent request of the user can be initiated by sending a request of the required financial information to the user via NBFC-AA Identifier. After the request has been sent, NBFC-AA will ensure that the requested information is shared after the consent of the user has been obtained via the NBFC-AA app. This is quite similar to an authorisation of collect request in a UPI (Unified Payment Interface) Application.

The data collected by FIU can be used in offering various services to its customers, such as credit facilities, personal financial services, wealth management advice, investment offers or even the upcoming financial services such as Robo banking, which is operated via Artificial Intelligence. The users that get their accounts registered with NBFC-AA have the sole discretion of granting or revoking the sharing of the data of the accounts held by them in any FIP. Also, the users may or may not grant consent to their data being exported in a structured format.

What constitutes Financial Information?

As per the master directions of RBI-DNBR, financial information shall include:

- Various kinds of Bank deposits

- SIP

- Certificate of Deposit

- Equity Shares

- Debentures

- ETFs

- Collective Investment Scheme (CIS) units

- Infrastructure Investment Trust units

- Real Estate Investment Trust units

- Deposits with NBFCs

- Commercial Paper

- Tradable Government Securities

- Bonds

- Mutual Fund units

- Indian Depository Receipts

- Units of Alternative Investment Funds (AIF)

- Balance under the National Pension System (NPS)

What is the Importance of NBFC-AA?

NBFC-AA or NBFC Account Aggregator provides the customers with specific information about their investments in various assets. Mostly, customers have a vague idea of their financial assets' holdings, such as mutual funds, insurance, fixed deposits, pensions etc. Therefore, NBFC-AA is relevant to users.

- The financial information of the users will be available on a common platform in a standard format, thereby increasing the uniformity and transparency of the data.

- The provision of financial information is solely dependent on the user's consent. There are usually proper agreements between the customer, aggregator and the financial service provider. This helps to prevent information abuse.

- The information provided by NBFC Account Aggregator is reliable since it is bound by the terms and conditions of the License, including customer protection, corporate governance, risk management, data security, grievance redressal and audit control.

- The role of NBFC Account Aggregator is limited to Account Aggregation only. However, deployment of investible surplus in investments will be permitted provided the same is not for the purpose of trading.

Duties and Responsibilities of NBFC Account Aggregator (NBFC-AA)

The duties and responsibilities of the NBFC Account Aggregator are as follows:

- It shall deliver facilities to the customer in accordance with the customer’s clear consent.

- It has to ensure that when it is providing services, the same shall be supported by relevant Agreement/Authorisation between the NBFC-AA, the customer and FIP's.

- It will not support any transactions by the customers.

- It shall undertake relevant mechanisms to ensure appropriate customer documentation.

- The information shall be shared only with the customer who owns it or to any other FIU, as approved by the customer as per the terms and conditions of the consent.

- It shall not deal in any other business except for the business of NBFC-AA. Permission has, however, been granted for the disposition of investible surplus in avenues not meant for trading.

- The financial information of a consumer that has been accessed from FIPs shall not be with NBFC Account Aggregator (NBFC-AA).

- No third-party services shall be used for taking up the business of an Account Aggregator.

- It will have a Citizen's Charter that overtly ensures the protection of the rights of customers. It cannot separate from any information that has been acquired by it from the customer or on his behalf till the time customer consents for the same.

- If there is a conflict between the financial information generated by the Account Aggregator and the financial information in the books of the FIP, the position shown in the books of FIP shall prevail.

Account Aggregators are certainly a reliable platform for sharing information digitally, contrary to the paper statements that were given by the individuals earlier. NBFC-AA has certainly reduced the risk for financial entities as the relevant data of the customers can be collected easily. However, this also means that the customers have lost real control over their financial data, which could become risky and give rise to poor quality data. Therefore, RBI needs to strengthen the regulations related to sharing financial data digitally.

Requirements for Obtaining NBFC-AA License

- A minimum of Rs. 2 crores for the NBFC Account Aggregator License is required. Nonetheless, the Company will have a time duration of 12 months after getting the principal approval of RBI for the purpose of raising money. No other services can be given by NBFC-AA other than for Account Aggregation.

- NBFC-AA will give details to the financial user regarding the customer. NBFC Account Aggregator is not capable of doing fund-based activity like the other NBFCs and prima facie, it is considered as NBFCs. NBFC-AA cannot use the details of the customer's financial assets for any different purpose.

- After getting the approvals from the regulator, NBFC Account Aggregator will have a time period of 12 months to set up all the vital technologies & tie-ups that are compulsory to carry out the business of aggregation.

- As per RBI, an entity which is involved in aggregating accounts of a specific financial sector which is regulated by the other regulators can be given an exemption from getting RBI's approval. These types of entities are not allowed to carry out financial activities like other NBFCs.

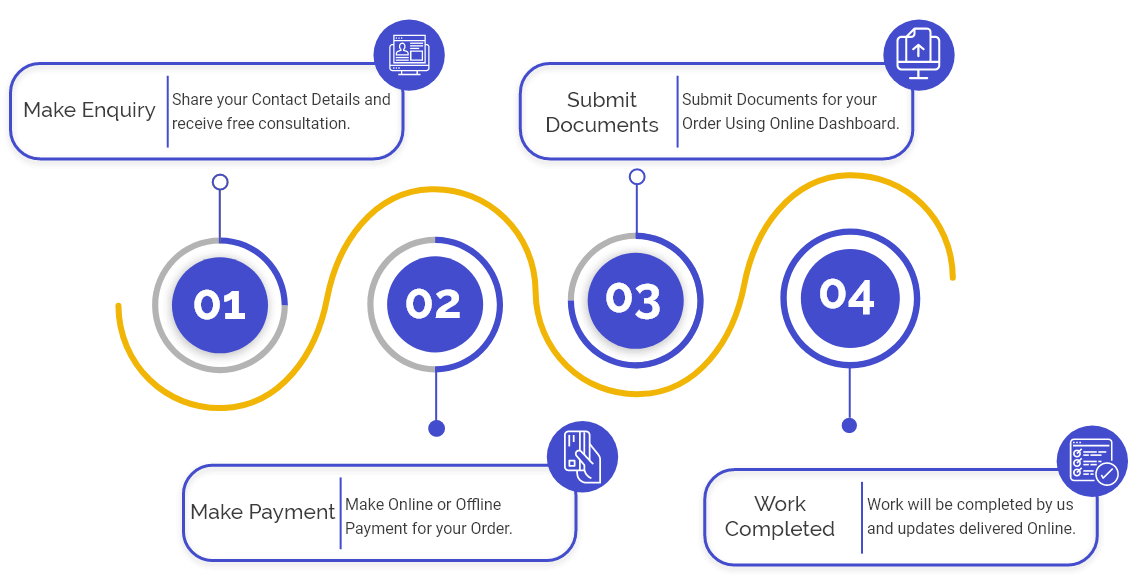

How to Obtain NBFC Account Aggregator License in India?

- The first step is the Company Registration as per the Companies Act, 2013;

- The organisation must have the essential resource to offer such types of services;

- To undertake the matter of Account Aggregator, the Company had to be prepared with the appropriate plan concerning adequate capital structure;

- The common character of the management shouldn’t be biased for any public interest;

- It’s mandatory to get a CoR (Certificate of Registration) from the Reserve Bank of India for the activities of the Account Aggregator;

- To obtain the CoR, it is required to make an application to the RBI by the applicant;

- There is a minimum requirement of at least Rs. 2 crores;

- Equipped with the system of IT (Information Technology) & data innovation framework so as to conduct services regarding Account Aggregation;

- The leverage ratio should be no more than 7 times;

- Promoters of the NBFC-AA must be fit & legitimate.

Revocation of NBFC Account Aggregator License

RBI-DNBR can cancel the NBFC Account Aggregator License if any of the following conditions are fulfilled:

- The Company stops to run the business as an Account Aggregator in India.

- The Company fails to fulfil any condition subject to which the Certificate of Registration as Account Aggregator has been issued.

- It appears to the Bank that the Company is no longer qualified to hold the Certificate of Registration.

- The Company violates any conditions mandatory to get the Certificate of Registration.

The Company fails to:

- Conform to the relevant directions that have been issued by RBI.

- Maintain accounts or publish information or disclose financial information as per the directions of the Bank or under relevant law.

- Submit its books of accounts or other pertinent documents to the Bank for an inspection.

Frequently Asked Questions

The core functions of an NBFC Account Aggregator are to gather data about the customer’s money and provide data in a sorted and united manner.

Yes, it is compulsory for all the existing business of account aggregation to apply for NBFC AA.

The Reserve Bank of India has the authority to regulate NBFC Account Aggregator.

No, the components that are managed by some other financial sector regulator are excluded from the purview of NBFC AA Registration.

No, there is no need to have NOF of Rs 2 crores before applying for NBFC AA Registration. However, the applicant must have the same while acquiring the Certificate of Registration from RBI.

After filing the application, an existing business of account aggregator can resume its operation till the time the apex bank grants COR (Certificate of Registration).

The entities are RBI (Reserve Bank of India), SEBI (Securities Exchange Board of India), IRDAI (Insurance Regulatory and Development Authority of India), and PFRDA (Pension Fund Regulatory and Development Authority).

No, it is not mandatory for banks to join the NBFC AA ecosystem.

The term FIU stands for Financial Information User.

At present, only the asset based information is available through an NBFC AA. Further, the term “asset based information” means ledgers, stores, protection strategies, shared assets, and annuity reserves.

NBFCs are registered under the Companies Act, 2013, whereas Banks are registered under the Banking Regulation Act, 1949. Further, an NBFC is not allowed to accept all kinds of deposits. However, Banks can easily accept the demand and time-based deposits from their customers.

An Account Aggregator works by gathering data from several records which may include financial balances, venture accounts, credit card accounts, and other shopper or business accounts.

Till the time the in-principle approval is valid, the entity will set its technology platform, complete its legal documentation and other formalities. Report all the necessary compliances to Reserve Bank of India.