An Overview of Founders Agreement

Founders Agreement is a Legal Contract or Agreement that is signed between all the co-founders of a company or an entity. This document describes all the duties, ownership, and initial investments made by each of the company’s founder. It is guided to make a founders agreement at the registration stage of an enterprise as it will lay out the roles & responsibilities of each of the co-founders.

Mostly, an agreement is made during the incorporation to avoid the uncertainty that may increase in future. It also establishes the expectations and goals of all the co-founders of the company by assigning each of them a particular role & responsibility towards the improvement of the enterprise.

Following are some essentials that are a must in any founders agreement:

- Business definition;

- Ownership details;

- Firm dissolution;

- Details of capital raised (by investors & founders);

- Roles & responsibilities of each co-founder of the company;

- Facts of dispute resolution;

- Compensation (salary drawn by co-founders);

- Facts of exit formalities for founders;

- Miscellaneous provisions (assignment of IPR, non-compete clauses, etc.).

Founders agreement is always good to be in a written format than being an oral contract. It is also essential that it be drafted with the help of legal word, which makes sure to eliminate all the loopholes that can be utilized.

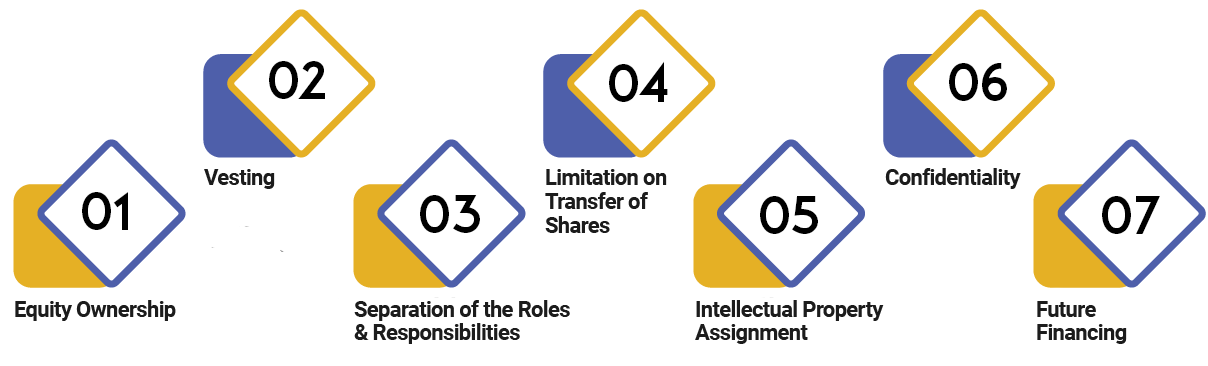

Key Terms of the Founders Agreement

- Equity Ownership

One of the essential terms of the Agreement is discovering the proportion of equity ownership or proprietorship of each of the company’s co-founders. The equity ownership of the company’s co-founders is determining, taking into consideration numerous factors such as the financial investment, present intellectual property, experience, and industry network. Also, equity ownership is relevant to find out the voting rights that the co-founder may exercise.

- Vesting

One of the key considerations of the founders agreement to be taken note of while drafting the Agreement is delivering a mechanism to deal with a condition where any of the co-founders present or is expelled from the company. For this aim, a vesting structure shall be incorporated in the Agreement presenting the way in which the founders shall take up the shares. The vesting of shares is done in the following manner:

Time-Based Vesting

Under this vesting, the shares owned by the founder shall be vested in proportion to the time spent by the company’s founder. The founder decides to quit the entity before the expiry of his or her term, the remaining shares of such founder will be returned to the entity or company. The Agreement shall state a time interval post which the vesting of shares shall begin, six months or one year. One possible problem with the time-based process of vesting is that recital of the founder is not taken into consideration.

Milestone Vesting

The vesting of shares in this vesting takes place when the milestones established in the Agreement are achieved by the entity. Milestone vesting rewards the performance of the business as a complete. In the event the founder leaves the entity before the milestones are achieved, the shares set aside for such founder doesn’t vest in him.

- Separation of the Roles & Responsibilities

The Agreement should clearly separate the roles & responsibilities of the co-founders can be categorized as operations, administration, marketing, and finance.

- Limitation on Transfer of Shares

Another essential factor to be taken into consideration in the Agreement is the rights & limitations of the founders to transfer their shares in the entity. The Agreement may furnish for a lock-in clause ordering the number of years before the expiration of which the co-founder cannot transfer shares possessed by him or her in the entity. The Agreement will deliver a mechanism to deal with a condition where the co-founder desires to exit the company before the expiration of the lock-in period. It is relevant to find out the method of valuation of the shares and the anti-dilution rights attached to the shares.

One of the methods to make sure that the company's equity is not transferred to outsiders is by delivering the right of first rejection will need the founders to transfer their shares to non-members or strangers only once the same has been declined to be abstracted by the other company’s shareholders.

- Intellectual Property Assignment

In usual business practice, innovations, ideas, and the intellectual property urbanized by an individual remain the property of that person. While drafting the Agreement, it should be taken care that the IPR of the co-founders are assigned to the company, and the same doesn't remain the property of a person. It is not unusual for entities to procure Patents, domain names, and Trademarks in the name of more or more of the co-founders at first, which later may be transferred in the company's name. The estimation of the company is overdone by the intellectual property owned by it. Moreover, the Agreement will include a clause describing that the intellectual property improved by the co-founders in the course of their connection with the entity shall always be possessed by the company. In dedicated high technology sectors, the founder can believe in sharing the intellectual property combined with the company or entity. But, this needs to be thoughtful and documented correctly.

- Confidentiality

The founders in connection with the company have knowledge of a lot of confidential 0r privately information about the company, some of which may represent trade secrets. The founders must be contractually limited from disclosing any personal detail procured by such co-founder during the course of their connection with the company as the similar may cause irreparable damage to the company’s business.

- Future Financing

The Agreement should clearly include the comprehensive provisions for the contribution of additional finances by the co-founder for the company's growth, i.e., whether the founders shall contribute the extra finances as debt or as equity, the way of evaluation of equity in case the financing is via equity and the interest rate to be paid by the entity in case the financing is a debt financing.

What are the Documents Required for Drafting Founders Agreement?

- Certificate of Company Registration;

- Documents from Intellectual Property Rights;

- Documents for Share-subscription;

- Company Contracts and Deals.

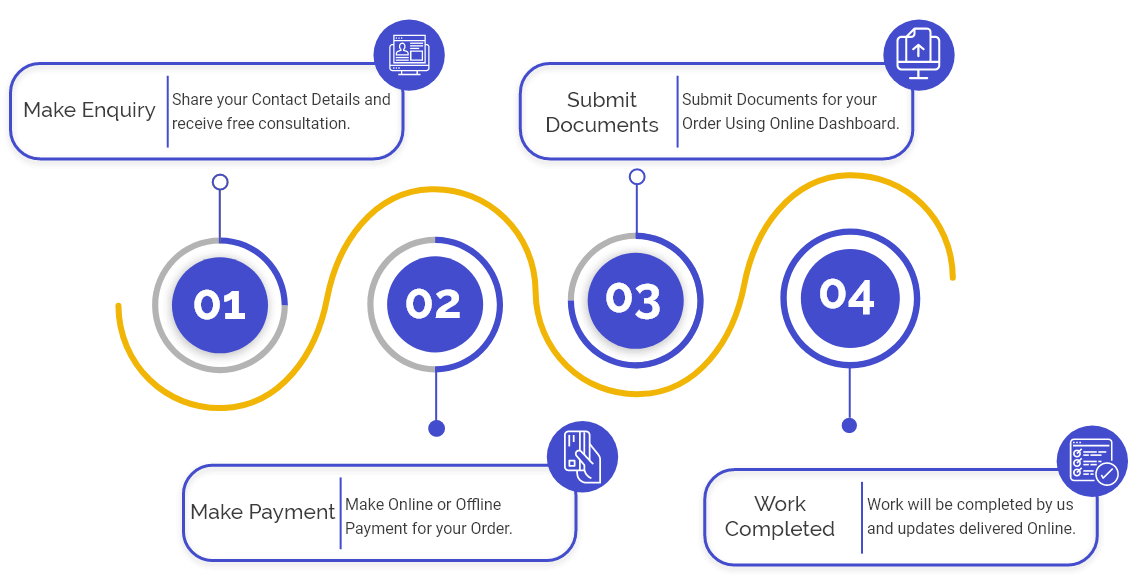

How to Create a Founders Agreement?

Following are vital steps that you should take to create founders agreements; they are not binding; however, they are a good comprehensive guide to follow as you work via this process.

- Step 1: Choose a Template

There are numerous templates all over the internet. Pick best fits for your start-up, or create your own with pieces from different templates. The purpose is to create a founders agreement that best fits your, your co-founders and your start-ups' needs. While the lawful talk might be frightening, don't worry about it, we will talk about that in step 4.

- Step 2: Fill out the Simple Sections

By going through and fill-out all the sections that don’t take a lot of thought. Things like your names, where you're situated, when the entity or a company begin, the company's name if you have that resolved. Usually, it is the thing that you don't have to consult with each other.

- Step 3: Take Some Time to Discuss the Difficult Stuff

Then it is the time for the difficult conversations. This when you and your co-founders need to go through all of the difficult things, from equity compensation, to stop and find out what you desire to do.

Such conversations can be challenging, and it is easy to swerve into personal feelings and offence. Always remember; you believe each other. You are working together. It's a business, not private. However, you all need to safeguard your interests and the company's interest. It is okay if such conversations take some days or even a couple of weeks, but consider fixing a date when it will be fully provided to ensure you don't keep going back and onward forever.

- Step 4: Get any Official Advice You Might Need

As mentioned above, it is an excellent concept to get a tax expert to aid you to figure the tax section. However, it's a great concept to have your founders agreement reviewed by a lawyer because it’s an officially binding agreement. Having an expert, lawful, and non-invested eye on the document can aid ensure that you are all safeguarded in the future. They are also probable to catch lawful formalities that you, as non-lawyers, might not have observed.

- Step 5: Get a Second Opinion

However, legal opinions are not the only opinions. It can be a great concept to ask a fellow entrepreneur or even an advisor to seek over your founders agreement. Individual entrepreneurs might be able to give advice depending on their experience and also notice stuff that a lawyer may not. It's never a bad concept or thought to utilize your community for something like this, presuming the community you have to establish a hard and well-informed one. So utilize your networks.

- Step 6: Sign & Review

Finally, give each co-founders time to examine their copy of the founders agreement, ask their lawyers if essential and then sign & date it. Once it’s been dated & signed by everyone, it's a lawfully binding document. Be sure to store a digital copy with everyone's signatures that your team can access for further reference.

Frequently Asked Questions

The term “Founders Agreement” denotes a written document that is used in the cases, such as Relative Split of the Equity Shares among the members of the company. Also, it deals with the tenure of how long the members will have to remain with the company for their shares to fully vest.

The essentials of a Founders Agreement are Definition of the Business, Details of the Capital Raised, Details of Ownership, Roles and Responsibilities of each co-founder, Compensation, Details regarding the Exit Formality, Dissolution of the Firm, Modes of Dispute Resolution, and Miscellaneous Provisions.

The advantages of a Founders Agreement are, determines the type of business entity, outlines the business plan, designates roles and responsibilities, structures the ownership, facilitates decision making, provisions of compensation, expulsion of co-founders, confidentiality.

The founders’ agreement will prohibit co-founders from involving in other employment openings, even if they are ousted or relieved from the company.

Yes, it is compulsory to get the founder's agreement executed on a non-judicial stamp paper for relevant value and get it notorised from the notary person.

The main reason behind the Notorisation is to make the agreement a legally enforceable one.

The penalty for the breach of provisions will depend on the severity of the dispute.

No, it is not compulsory to get the Founders Agreement registered.

Yes, being a legal document, there is a specific format prescribed for drafting a Founders Agreement.

There are no documents required to draft a Founders Agreement.

The steps involved in the Procedure are Contact an Experienced Lawyer, Draft the Founders Agreement, Send For Review, Get it Notarised.

Normally, a period of 3 to 4 days is required to draft a Founders Agreement.

Yes, it is always advisable to consult professionals for drafting a Founders Agreement.