An Overview of Society Registration

A Society is an institution of several individuals with common interests collectively acting together to serve some function. Usually, Societies are registered for the advancement of charitable activities such as culture, art, sports, education, music, religion, etc. In India, the Registration of a Society under the Society Registration Act sets certain procedures for the sake of its registration & operation. This Act was introduced with the aim of augmenting the legal stipulations of Society Registration for the advancement of science, literature, fine arts, or distribution of awareness for generous purposes. The Act has been accepted by several State Governments of India or with further amendments.

To register a Society in a particular state, the founding members must comply with specific conditions mentioned under the Act. Once the Society is registered, the Society must follow the post-registration norms as directed by the competent authority to stay compliant.

Purpose of Society Registration

According to Section 20 of the Act, 1860, a Society Registration can be done for the following purposes:

- Grant of charitable assistance;

- Collections of natural history;

- Creation of military orphan funds;

- Collections of mechanical & philosophical inventions, instruments, or designs;

- Grant of charitable aid;

- Diffusion or promotion or instruction of useful knowledge;

- Foundation or maintenance of reading libraries or reading rooms;

- Foundation or maintenance of public museums or galleries;

- Promotion of fine arts;

- Diffusion of political education.

Benefits of Society Registration

- Society gains a status of a legal entity.

- Sell, buy, rent as well as the right to lease are the facilities that can be availed by a Society Registration.

- Membership of a Society may change, but it will continue to be a separate entity.

- A Society can avail of Income Tax exemption if a Society is incorporated.

- In case of unlawful activities, the members are held to pay the debts as well as obligations.

- In the case of profit, if members incur debts and obligations for the purpose of obtaining money, the members are liable to pay; else, members can't be held liable.

- Incorporated Society is required to meet minimum requirements which are set by the Incorporated Society Act 1908, which gives an assurance to members of the Society.

- Bank accounts can be opened by Society.

- Society gains recognition in front of Forums as well as Authorities.

Some Important Points of Society Registration in India

- At least 7 or more members are required for the Society Registration in India. Apart from members from India, companies, foreigners and other registered societies can also register for MoA of the Society;

- For Society Registration in India, the establishing members must agree with the Society's first name and then prepare for the Memorandum, followed by certain Rules & Regulations of the Society;

- Society Registration is maintained by State Governments and the application for the registration must be created to the specific authority of the particular state where the registered office of the Society is situated.

- Similar to Partnership Firms in India, Society can also be either registered or unregistered. However, only the registered societies will be able to withstand consigned properties and/or have an ensemble filed against or by the Society.

Documents Required for Society Registration in India

Following are some vital documents required for Society Registration in India:

- PAN Card of all the members of the Society must be submitted along with the application.

- The residence proof of all the Society's members has to be submitted such as bank statement, utility bank, passport, Aadhaar Card, or Passport.

- The MoA has to be prepared, which will contain some clauses and information as mentioned below:

- The objectives and work of the Society for which it is being established;

- It will contain the registered office address of the Society;

- The information of all the members establishing the Society.

- Rules & Regulations of the Society: These must be prepared which will contain the following details:

- Rules & regulations by which the working of the Society will be governed & the maintenance of day to day activities;

- Information regarding the Auditors;

- Ways for the disintegration of the Society will also be mentioned;

- It will contain certain rules for taking the Society Membership;

- Forms of Arbitration, in the case of any dispute between the Society members;

- The information regarding the Society meeting and the frequency with which they are going to be held is to be mentioned.

- Copy of the address proof where the registered office of a Society is located along with a No Objection Certificate (NOC) from the landlord, if any, has to be attached.

- A covering letter mentioning the objective for which the Society is being formed will be annexed to the start of the application. It will be duly-signed by all the founding members of the Society.

- A detailed list of all the members of the governing body must be given along with their signatures.

- The President of the Society must give a declaration that he or she is willing & capable of holding the said post.

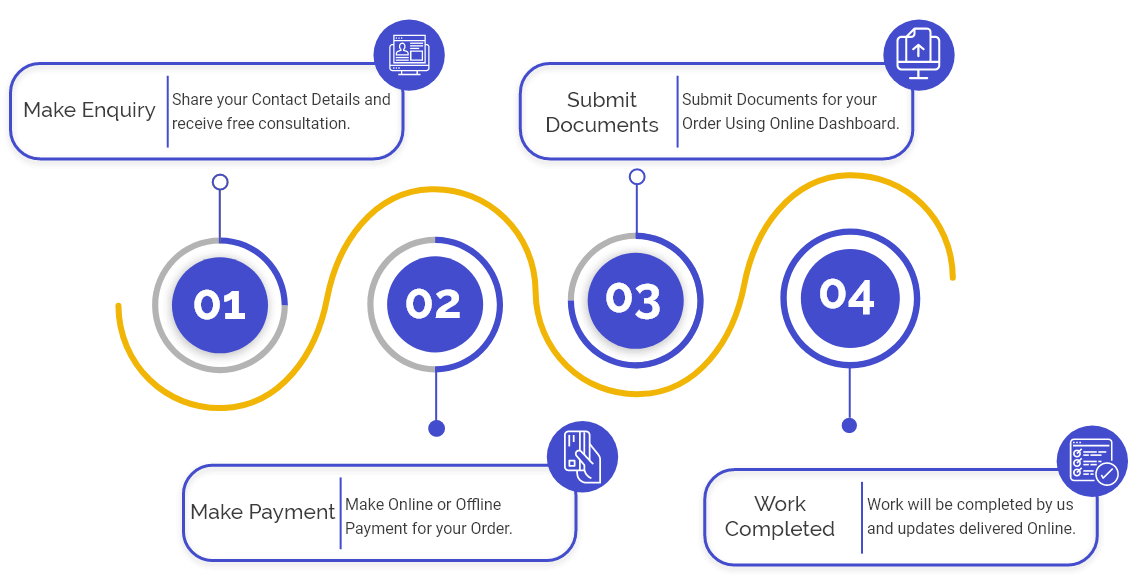

Procedure for the Registration of a Society

Step 1: Select Unique Name: The applicant must conduct comprehensive research to file a unique name for the proposed Society. One must ensure that the name is not deceptively similar or identical to another incorporated Society/Corporate body. In case you choose an existing name of a Society, then the party must provide written consent to the Registrar.

Step 2: Draft the Memorandum of Association: Now, each establishing member of the Society must sign the Memorandum with the Rules and Regulations of the Society. It should be witnessed by Notary Public, Chartered Accountant, Oath Commissioner, Gazetted Officer, First Class Magistrate or Advocate with their official stamp and complete address.

The Memorandum must contain the clauses given below:

- Name Clause;

- Objectives Clause;

- Registered Office Clause;

- Details such as names, occupations and addresses of the Executive Body/ Governing Body.

Rules and Regulations of the proposed Society should be certified by the President, Vice President and Chairman of the Society. It must specify the aspects mentioned below:

- Constitution of the Society;

- Terms of Member’s Termination;

- Details of the Office Bearer;

- Audit Compliance;

- Provision of the Meetings;

- Provisions of Legal Disputes;

- Income Source of the Society;

- Membership and Subscription;

- Election Norms: Society’s Dissolution.

Step 3: Prepare other Necessary Documents: Documentation plays a vital in the Registration criteria. Hence, affix the documents of Cover Letter, Minutes of the Meeting, Declaration, and ID Proof, as prescribed by the Society Registration Act, 1860.

Step 4: Documentation with the Concerned Registrar: Once you have prepared all the documents, submit them to the concerned Registrar of your State with the fee. If the Registrar feels that your provided information is valid, then he will declare your Society as registered. You can check the Society Registration status on the official website of the Municipal of Corporate Affairs. Generally, it takes around one month to register the Society.

Post Registration Compliances

- Annual income tax filing;

- GST Registration, if applicable;

- Secure PAN Card;

- Bookkeeping and accounts;

- Open a bank account;

- Professional Tax Registration, if applicable;

- Compliance with the RoF – filing annual General Meeting resolution, accounts to be disclosed and member list to be filed with RoFs.

Tax Exemption

Like any other legal entity, the Society is also accountable for paying taxes and the Society must obtain 80G Certification from IT authorities to avail of exemption.

Limitations on Society Registration

The society also needs to bear certain limitations, which are as follows:

- Only Public Trusts can enjoy Tax exemptions provided they are considered to be engaged. In charitable activities, according to the Income tax department.

- The possibility of Equity Investment, as well as ownership, is ruled out in the case of Societies as they can't go for it. Thus, it keeps commercial investors at bay who want to indulge in Microfinance.

- It lacks professionalism.

- The managerial practices are not followed mostly.

- Commercial investors consider it a risky investment which deters them from investing in bulk.

FAQs of Society Registration

The term “Society” denotes a group of people who came together to achieve a common motive.

The Society Registration Act 1860 acts as governing law for a society incorporated in India.

Yes, after registration, society becomes a Separate Legal Entity.

The purpose of Society Registration is to give a boost to the legal conditions of Society. It helps a Society to get legal status in India as well. In other words, it becomes a legal entity.

Society Registration helps in improving the civic life of the people of the country.

A Minimum of 7 seven members are required to incorporate a Society in India.

No, society will continue to exist.

Yes, a society can avail Income Tax Exemption under the Income Tax Act.

Individuals, Foreigners, Company, Partnership Firm, and Registered Society are eligible to obtain Society Registration.

The term “components” include Name, Object, and Details of the Members and Registered Office.

The term “Right” includes the Right to Vote, the Right to receive and copy of By-laws, the Right to Statement of Account, and the Right to Attend General Meetings.

The steps involved are convening a general meeting; passing of the resolution; signing of resolution; and submitting the same to the registrar.

No, as per section 14 of the Societies Registration Act, members are not eligible to receive a share in profits.

One can check the status on the Official Website of the MCA (Ministry of Corporate Affairs).

No, relatives are not eligible to become a member of a society.

Yes, the MOA of a Society can be amended by passing resolution in the EGM, and submitting the same to the registrar within 30 days.

The term “General Body” denotes the members who have subscribed the Memorandum of the Society.

The documents required include Name; Office Address Proof; Identity Proof; Copies of Memorandum of Association; and Copies of Society’s By Laws.

The steps involved are Select Name; prepare the Memorandum of Society; Formulate the Rules and Regulations; and Get it Registered by the Registrar.